DC Tracker

Web Platform • Oct – Dec 2024 • Case Study

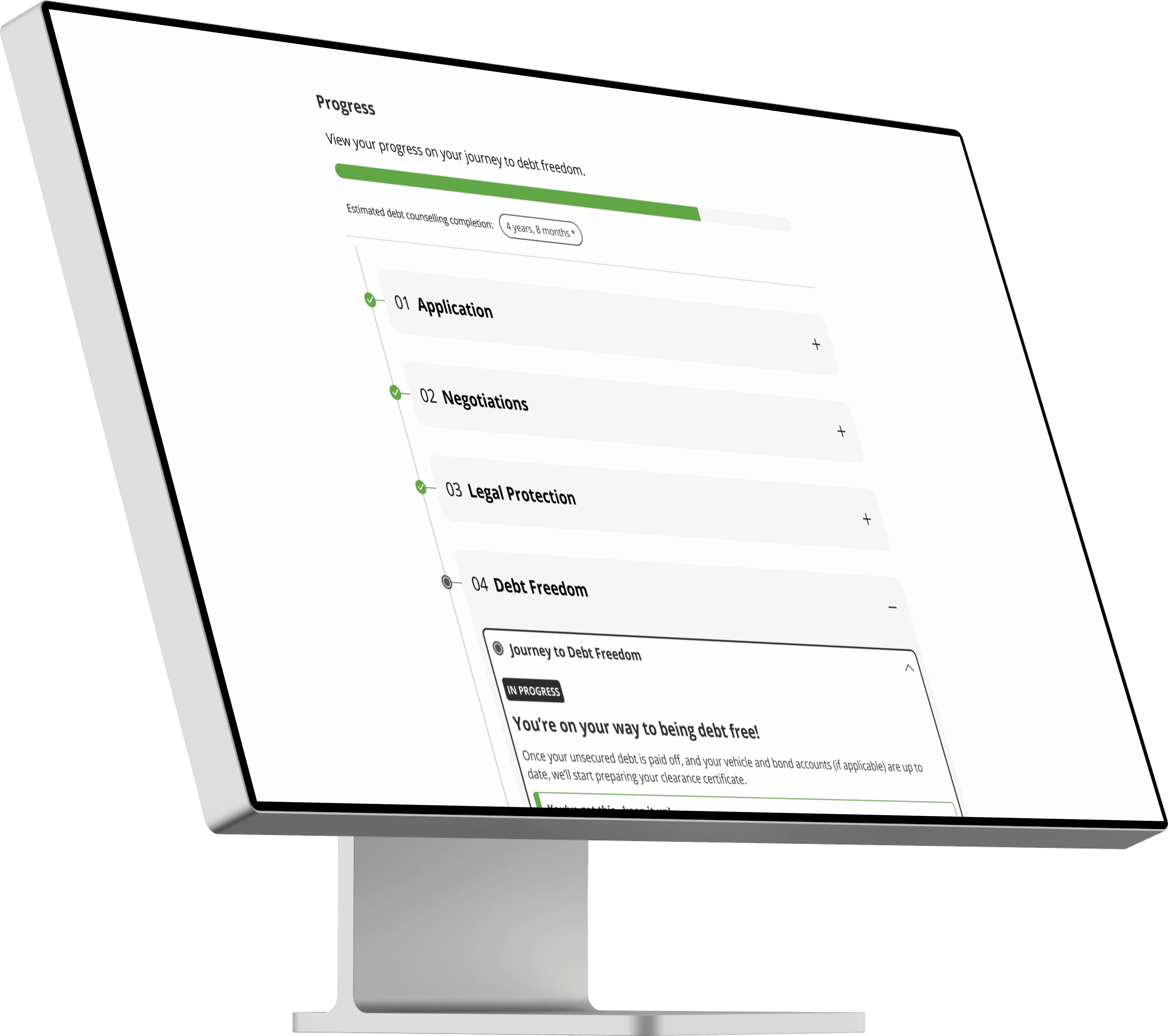

A journey tracker for clients of South Africa’s leading debt counsellor that improved engagement and retention

Context

DebtBusters, South Africa's leading debt counsellor, aimed to use their web platform to help clients track their debt counselling progress, and by doing so reduce common support queries related to process.

My role

Led UX and UI design as part of the digital product team

Co-ordinated content with business analysts and the writing team

Impact: Retention

Business

This feature led to a dramatic improvement in long-term client retention: clients who used DC Tracker retained 12% more than others over a 6 month period. Their flatter retention curve showed stronger sustained engagement, positioning the project as a key retention driver. The project’s success demonstrated the client portal’s strong impact on long-term user retention and was used to highlight its business value.

Users

It provided high value to clients as, for the first time, they were able to visually see and manage their journey towards debt freedom. The modular design and progressive disclosure patterns made it useable and accessible.

01 / DISCOVERY

OVERVIEW

DEBT COUNSELLING

Debt counselling is a legally-protected service that helps individuals manage and repay their debts through structured financial planning.

DC PROCESS

In South Africa, entering debt counselling involves about 14 steps, after which clients are legally protected for up to 5 years while reduced repayments are negotiated, helping them recover financially.

USERS NEEDS

Debt counselling clients need a clear way to track their progress because the process can feel confusing and uncertain. Without visibility into their journey, clients may lose motivation or trust. A simple progress tracker can boost engagement and confidence.

THE CHALLENGE

How can we make this complex, 14-step process navigable, understandable and actionable for users?

02 / IDEATION

CONCEPT

Transit interface design was a key reference in conceptualising the representation of a user's journey to debt freedom.

These maps have strong mental models, and clearly convey the notion of one's position in a journey.

WIREFRAMES

03 / VALIDATION

04 / SOLUTION

HIGH-FIDELITY MOCKUPS

05 / KEY TAKEAWAYS

This project expanded my collaboration skills beyond the DigiTech team, requiring engagement with multiple business units, many unfamiliar with UX processes. It taught me to adapt my communication style, framing design concepts in terms each department could relate to and aligning everyone around the shared goal of supporting clients on their debt-free journey.

Simplifying complex, emotionally loaded processes demanded careful step-by-step evaluation to create an experience that supports rather than overwhelms users. Two UX principles guided this approach:

Information Chunking: Grouping related steps reduced perceived complexity and helped users orient themselves within the journey.

Progressive Disclosure: Building on chunking, this method ensured users only encountered information as needed, maintaining clarity and confidence.

Finally, this project strengthened my ability to handle stakeholder input diplomatically, balancing enthusiasm for new ideas with a firm advocacy for usability, ensuring design decisions always served the user experience first.

This case study highlights my contributions to features developed as part of my role at Confluent Services. The work was completed collaboratively, and all product assets, designs, and trademarks remain the property of their respective owners.

Want to learn more about this project?

Get in touch